This is one of those political moments you just don’t see every day: President Trump and Senator Elizabeth Warren (D-Mass.) just had a “productive” phone call, finding surprising common ground on the crucial issue of affordability, as per The Hill. That’s right, two of the most powerful political heavyweights from opposite sides of the aisle are aligning to tackle high consumer costs, especially when it comes to sky-high credit card interest rates.

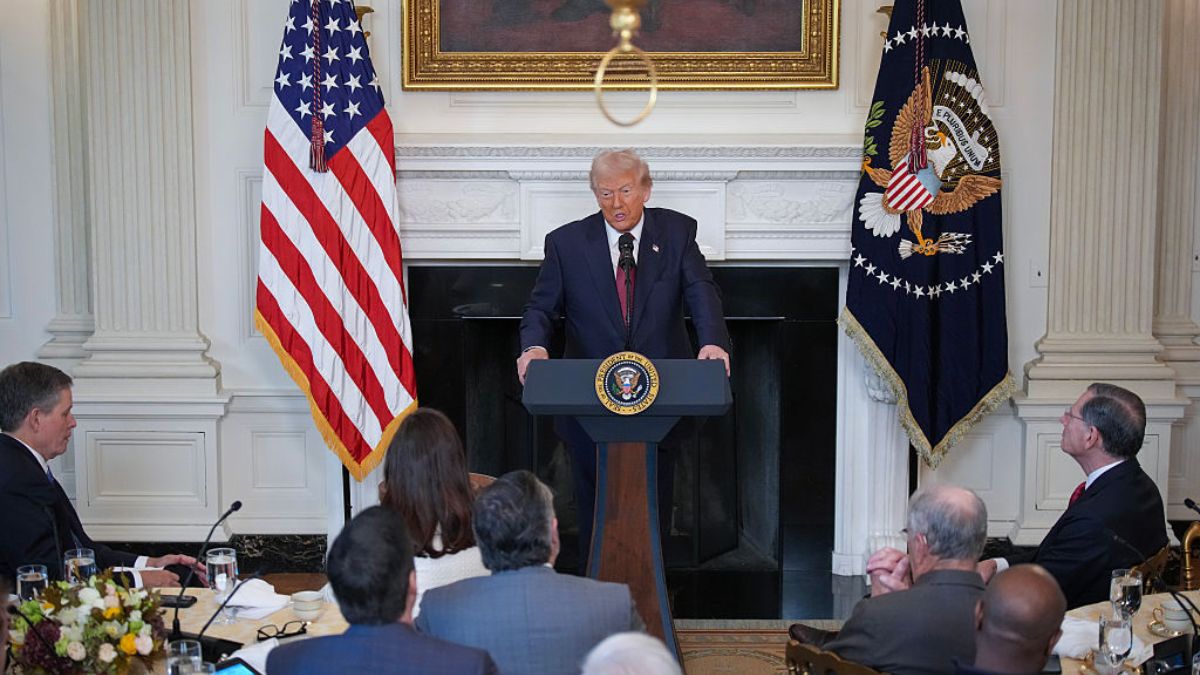

This sudden, focused push on consumer debt comes just days after President Trump publicly declared war on credit card companies. He took to Truth Social and made it absolutely clear that he believes the American public is getting totally ripped off. The president is demanding that these companies cap their interest rates at 10 percent. He pointed out that current rates often soar into the 20 to 30 percent range, or even higher, which is simply unsustainable for many families.

President Trump specifically claimed that these excessive rates were allowed to fester unimpeded during the “Sleepy Joe Biden Administration.” He’s laser-focused on affordability, and honestly, you can’t blame him. When you’re paying huge interest every month, it absolutely shreds your budget.

This unusual partnership highlights just how critical the affordability issue has become in the current political climate

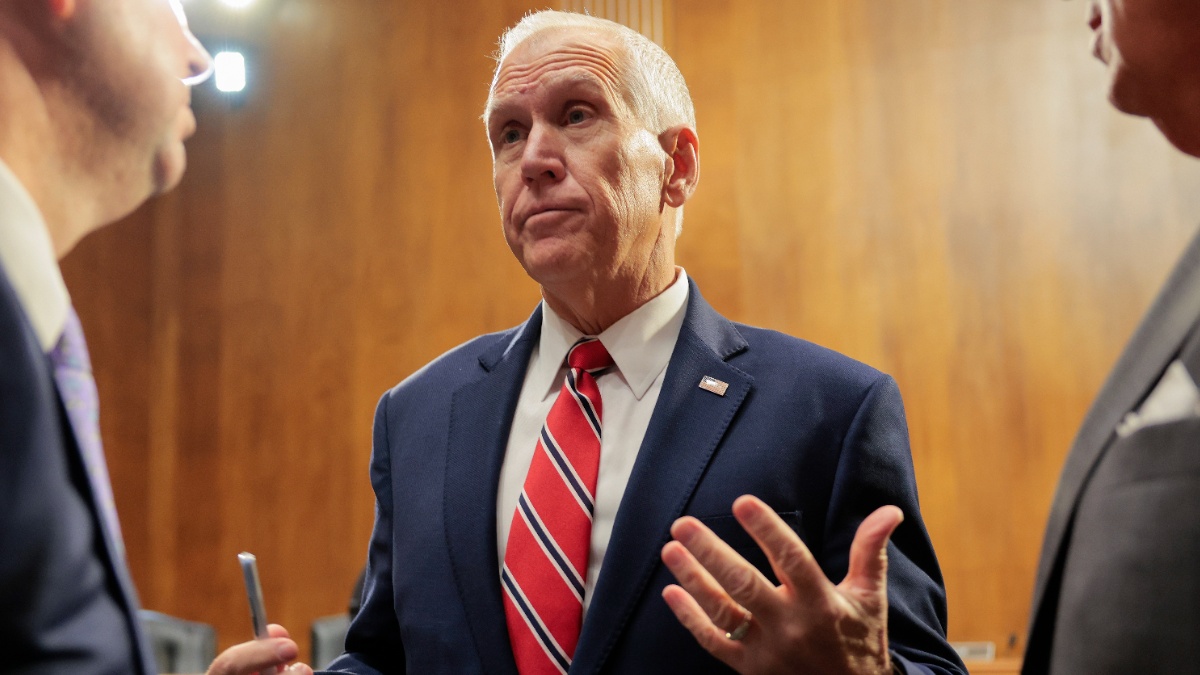

So, how did Senator Warren get into the mix? She set the stage by giving a major speech where she directly criticized the president’s record on affordability policies. Warren stated that despite promising to lower costs on Day One, she believes his administration has done nothing but raise costs for American families. Warren made it known that if President Trump truly wanted to cap credit card rates or lower housing costs, he needed to “use his leverage and pick up the phone.”

Well, he picked up the phone! Warren confirmed that President Trump called her shortly after her remarks. She didn’t waste the opportunity, delivering the exact “same message on affordability to him directly.” She stressed to the president that Congress is ready to pass legislation to cap those credit card rates, but he would need to seriously fight for it to ensure it passes. That’s a huge legislative lift, but capping rates at 10 percent would be a massive relief for millions of Americans struggling with debt.

Senator Warren also urged President Trump to use his influence to push House Republicans to pass the bipartisan ROAD to Housing Act. This bill is designed to build more housing and ultimately lower housing costs across the country. It’s pretty rare to see a bill move through Washington with broad support, so it’s worth noting that the ROAD to Housing Act already passed the Senate with unanimous support.

The White House quickly confirmed the conversation. An official described the call as “productive,” stating that President Trump and Senator Warren discussed credit card interest rates and housing affordability specifically for the American people.

The White House is clearly trying to reclaim this topic ahead of the upcoming midterms. While President Trump and Republicans successfully campaigned on affordability in the 2024 election, Democrats have found great success messaging on the exact same issue in a number of special and off-year elections over the past year.

Published: Jan 13, 2026 01:00 pm