President Donald Trump’s threat to impose 100 percent tariffs on Chinese imports has drawn a strong response from Beijing, which warned on Sunday that it is prepared to take “corresponding measures” if the U.S. moves forward with new levies. The announcement comes after China imposed restrictions on rare earth exports, which are essential to U.S. manufacturers, including those producing defense equipment and advanced technologies.

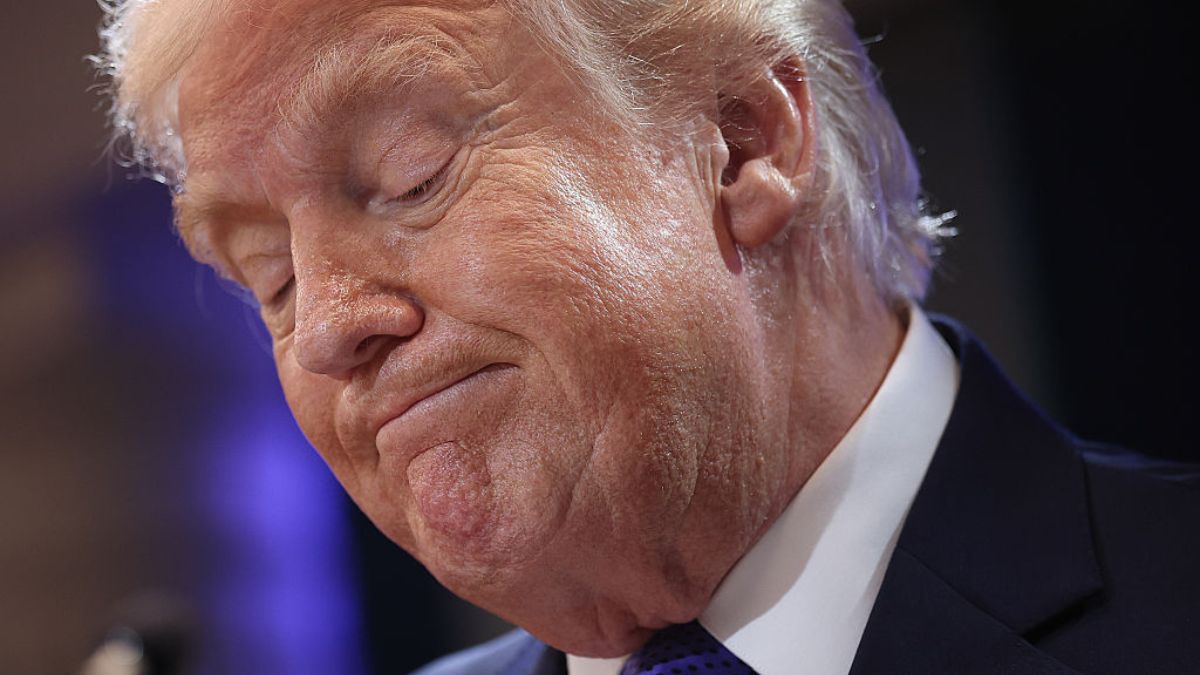

Trump’s tariff announcement, made via Truth Social on Friday, indicated that the tariffs would go into effect on November 1, alongside unspecified export restrictions on “any and all critical software.” According to Politico, the president criticized Beijing’s curbs on rare earth exports as “absolutely unheard of” and claimed they were morally unacceptable, while also suggesting that the move could affect an anticipated meeting with Chinese leader Xi Jinping during the APEC summit.

China’s Commerce Ministry rejected the U.S. concerns, describing the export curbs as a justified response to what it called discriminatory U.S. trade measures, including restrictions on high-end semiconductors. The ministry dismissed Trump’s tariff threat as a “classic case of double standards” and emphasized that China does not want a trade war but is prepared to retaliate.

Considering The Broader Implications Of Rare Earth Supply And Trade Tensions

The dispute highlights the strategic significance of rare earth minerals. These materials, commonly referred to as rare earth magnets, are critical for manufacturing a range of products, from electric vehicles to medical imaging equipment. They are also essential for U.S. defense systems, including munitions, precision weaponry, and night vision devices. China’s dominance over the global rare earth supply chain has long been a concern for U.S. policymakers, and the latest export curbs underscore the leverage Beijing can exert in international trade disputes.

The rare earth restrictions are part of a broader series of non-tariff measures that China has implemented in response to U.S. actions earlier this year. The Trump administration has continued to restrict Chinese access to advanced computer chips and imposed other trade barriers, which Beijing has framed as harmful to its economy and a violation of fair trade principles. These measures have included cuts to purchases of U.S. soybeans and other retaliatory steps aimed at highlighting China’s negotiating power.

Economic analysts warn that a rapid escalation of tariffs and countermeasures could have immediate effects on global trade and supply chains. The looming dispute comes at a sensitive time for U.S. retailers and shippers ahead of the holiday shopping season, raising concerns about inflationary pressures and potential disruptions in the flow of goods. Even a partial escalation could create uncertainty for companies that rely on Chinese raw materials and manufacturing.

The recent exchange between Washington and Beijing marks a critical juncture in the ongoing trade tensions between the two countries. While the two sides had previously agreed to reduce tariff rates and maintain dialogue through high-level meetings between Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, the rare earth export curbs and the U.S. tariff threat have complicated those efforts.

Trump’s subsequent statements on Truth Social attempted to downplay immediate concerns, asserting that the U.S. does not intend to harm China and portraying the situation as a temporary disagreement. However, analysts in Beijing are unlikely to view such assurances as sufficient, given the strategic importance of rare earths and China’s broader trade objectives.

Craig Singleton, a senior fellow at the Foundation for Defense of Democracies, described the situation as “a new dynamic of mutually assured disruption,” where both countries continue to test the limits of economic interdependence without triggering uncontrollable fallout. The outcome will likely depend on whether either side chooses to escalate further or seek a negotiated settlement to stabilize trade relations.

Published: Oct 13, 2025 09:58 am