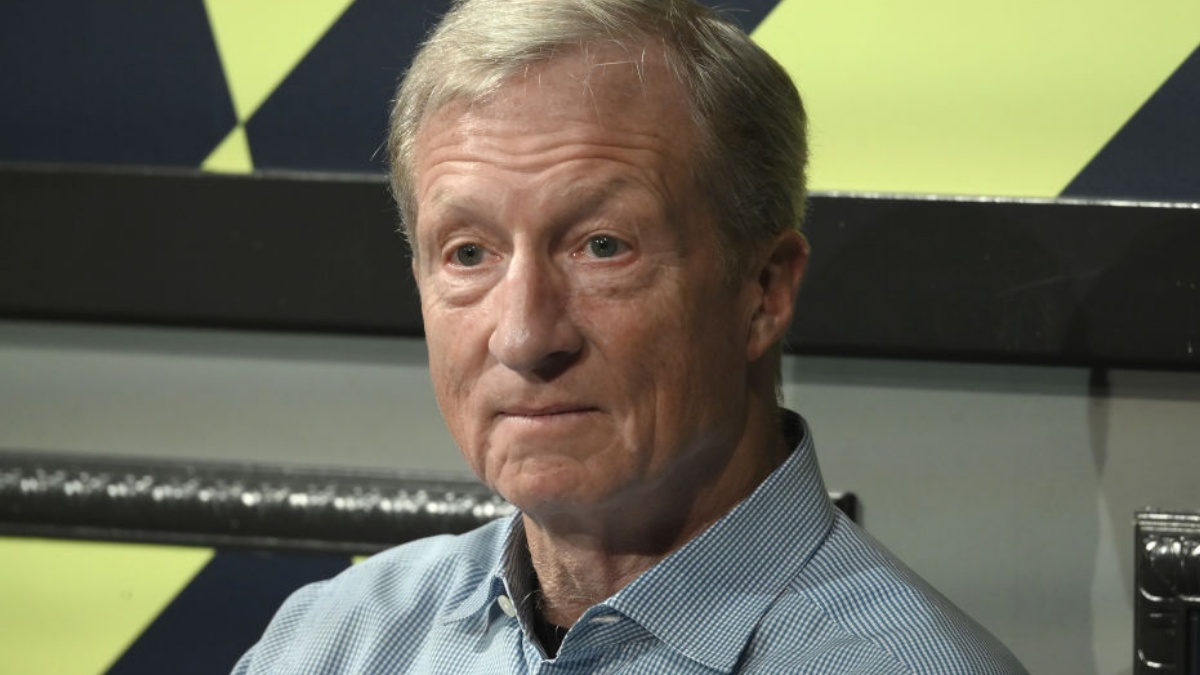

Tom Steyer is telling California labor leaders he will push for a 2027 special election to raise corporate taxes, framing the effort as a move to close what he calls a “Trump tax loophole.” The proposal places tax policy at the center of the state’s gubernatorial race.

As reported by Politico, Steyer is targeting California’s Proposition 13, the landmark law that limits property tax increases, particularly for commercial properties. He wants commercial properties assessed at current market value, an approach commonly known as split roll.

Steyer confirmed he has been discussing the plan and argued that federal actions under President Donald Trump have increased pressure on California’s budget. He said a special election would be required to move quickly, adding that “the only way to pass that is with a special election.”

A high-stakes tax fight in the governor’s race

Steyer’s proposal centers on revising Proposition 13 so commercial properties are taxed based on updated market values rather than decades-old assessments. Progressive groups and public sector unions have long argued that the change would generate billions in new revenue, amid the federal voter ID bill milestone.

He tied the urgency to what he described as a Republican backed bill passed last year that included health care cuts and could “blow a hole” in the state budget. By linking Proposition 13 to Trump’s California business interests, Steyer is framing the measure as both a fiscal and political contrast.

A central question is whether Steyer, a billionaire investor with a history of self-funding campaigns, would finance the ballot effort himself. While he suggested to labor leaders he would do what it takes to pass split roll, he declined to commit when asked directly whether he would spend his own money as governor.

Steyer is competing in a crowded Democratic primary field and is seeking endorsements from major labor organizations. Polling places him below 10 percent, behind Democrats including Rep. Eric Swalwell and former Rep. Katie Porter, as well as leading Republicans such as former Fox News host Steve Hilton and Riverside County Sheriff Chad Bianco.

Raising taxes on corporations and wealthy individuals has been a long-standing goal for organized labor, particularly public sector unions concerned about budget cuts. Voters rejected a similar split-roll ballot measure in 2020 despite significant financial backing, and Steyer contributed $500,000 to that effort.

Other revenue ideas are also circulating, including legislation backed by SEIU to close the so-called water’s edge loophole, which allows corporations to shift profits offshore. Separate headlines have also focused on Meta’s digital persona patent.

SEIU UHW is promoting a separate ballot initiative that would impose a one-time 5 percent tax on billionaires’ assets to offset federal cuts to Medi-Cal. Steyer has expressed support for closing the water’s edge loophole and cautious backing for a billionaire tax, but his primary focus remains revising Proposition 13 through a 2027 special election.

Published: Feb 18, 2026 07:15 pm