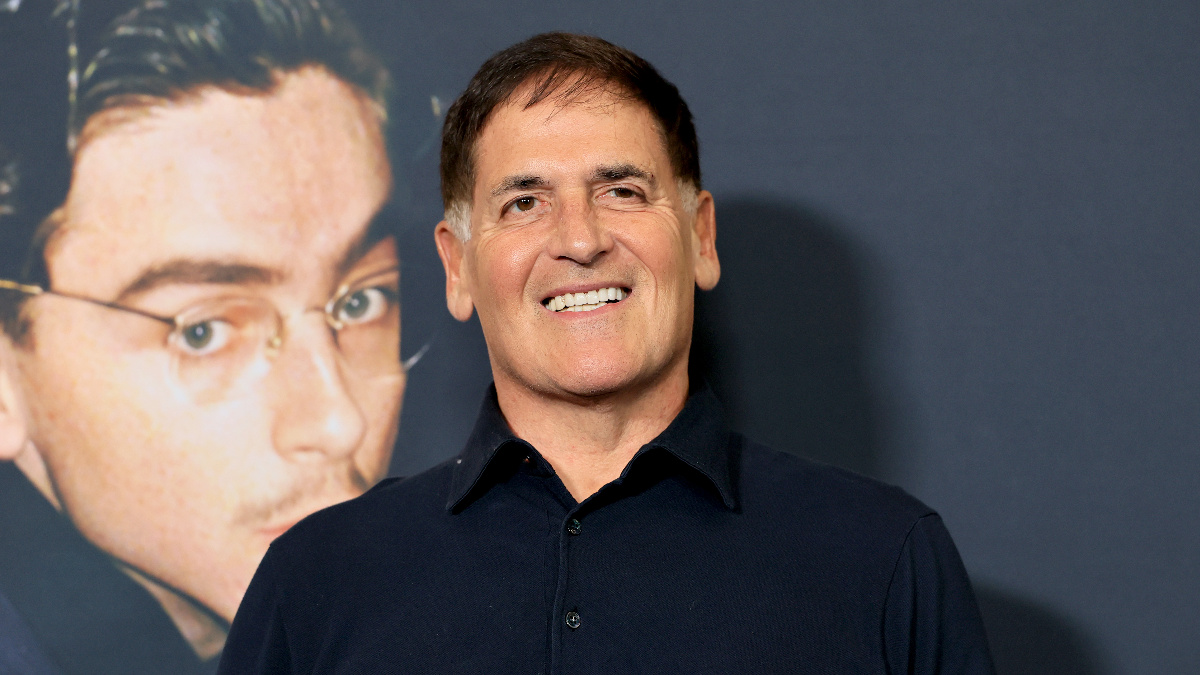

Mark Cuban has floated a provocative idea that he says could erase the entire U.S. national debt: aggressively fining insurers and healthcare providers for billing abuses. The issue came to light after comments highlighted by Yahoo Finance, where Cuban argued that even modest penalties could generate enormous revenue if enforced consistently across the system.

In a post on X, Cuban suggested the federal government impose a $100 fine every time an insurer or provider over-billed a patient, incorrectly denied care, or misrepresented out-of-pocket costs. He claimed that the sheer scale of these practices means the fines could add up quickly, potentially enough to eliminate the national debt entirely.

The comment tapped into widespread frustration with a healthcare system that many Americans find confusing and punitive. Cuban argued that insurers and providers benefit from fear and information gaps, particularly when patients are sick or injured and least equipped to challenge complex billing or coverage decisions. He compared this dynamic to other consumer-facing systems where opaque rules quietly shift costs onto individuals, such as when diners discover unexpected charges only after seeing the final bill, as in this recent case involving a Texas Roadhouse customer.

This was meant as a challenge to the entire structure

Cuban framed the fine proposal as part of a broader call to dismantle what he sees as a broken market, urging policymakers to break up large insurance companies and force them to divest non-insurance businesses. He argued that consolidation has distorted pricing and competition, and added that hospitals and pharmaceutical wholesalers should face similar scrutiny.

Alongside the fines, Cuban highlighted a more immediate reform gaining traction at the state level: allowing cash payments for medical services to count toward insurance deductibles. The policy, promoted by Scalpel Policy Solutions founder Tanner Aliff, aims to let patients benefit from lower cash prices without sacrificing deductible progress. Under these rules, a patient could pay a few hundred dollars for a service instead of a several-thousand-dollar insured rate and still receive deductible credit.

So far, versions of this reform have been adopted in Texas, Indiana, Tennessee, and Oregon. Cuban praised these states and called for nationwide adoption, arguing that deductible credit would encourage price transparency and give patients a reason to shop for care. He compared the issue to other hidden-cost disputes, including concerns raised after shoppers reported unexpected totals at self-checkout, like in this Walmart card reader case.

Skeptics question whether most patients can realistically navigate this system. Financial planner Jae Oh pushed back on Cuban’s optimism, arguing that people dealing with illness often lack the time, energy, or expertise to negotiate prices and coordinate payments, and warning that consumer-driven solutions may oversimplify the realities faced by patients with serious health needs.

Cuban rejected that criticism, pointing to his own experience helping people navigate insurance hurdles and pay for care, and argued that patients are already performing these tasks out of necessity.

Published: Jan 3, 2026 07:30 am