When building your urban empire in Cities: Skylines 2, you might have questions about tax rates and whether you should raise or lower taxes. This will be a central aspect in running your city in the mid-to-late game, so it’s a good idea to check out this guide!

Cities” Skylines 2 Taxation Guide — Different Forms of Taxes

There are 4 primary forms of taxation in Cities Skylines 2:

- Residential

- Commercial

- Industrial

- Office

Each of these can vary in how much revenue they make for your cities. Keep in mind some conditions benefit from higher or lower taxes.

- Higher taxes on Commercial, Industrial, or Office zones may drive higher revenue but hurt their chances of succeeding in the long run

- Higher taxes in general mean residences have a chance of experiencing high rent, while businesses need more customers

- Lowering taxes will make businesses do better and keep citizens happy, but will make you more dependent on government subsidies

Related: Cities Skylines 2 Housing Guide: Rent, Demand, Zoning, and Tips

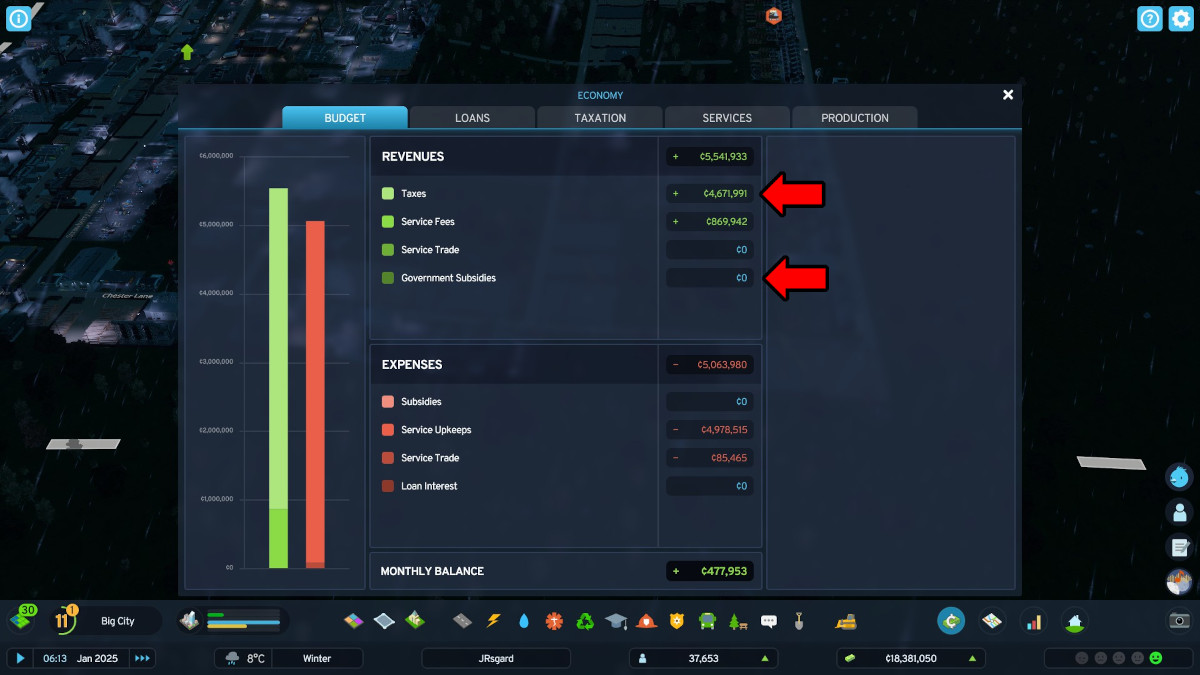

There’s a sweet spot you must meet, which I’ll go over next. But you want your taxes to hit a rate where you’re not receiving government subsidies: the game automatically gives you these if you’re struggling. While it’s a nice cushion, it won’t keep up too high if your city starts spiraling into disrepair. Keep taxes from being too low. If you are getting no government subsidies, it means you’re running your city right.

When You Should Raise or Lower Your Tax

As I have now gone over in two separate guides about stopping losses early on and staying sustainable, taxes can be a bit tricky to nail down. I’ll summarize it here in three points:

- Lower taxes for commerce and residences until your city grows past the 10,000 mark

- Incrementally raise the residential taxes, never exceeding 13-15%

- Don’t touch other zone taxes until you’ve got decent amounts of each; then don’t exceed 13-15%

The reasons for not exceeding 15% are what I touched upon earlier. Civilians will generate -3 to -4 happiness for high taxes, while businesses will struggle to do well or retain employees. For this reason, you might also notice the Service Charges option in the Services menu: charge a little bit over the regular amount, maybe 12% more, and this will help keep subsidies low.

I was able to strike this balance and slowly add to my city, expanding offices and industry while adding residences and commerce while staying cash-positive and receiving no government subsidies.

Published: Nov 1, 2023 03:11 pm